Hello, property-tax payers of Dallas County.

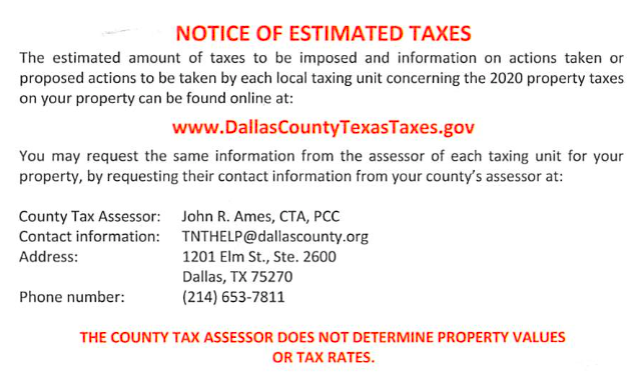

By now you’ve probably received a postcard with no return address in the mail that states “notice of estimated taxes,” all shouty in red letters.

The next sentence is a real thinker: “The estimated amount of taxes to be imposed and information on actions taken or proposed actions to be taken by each local taxing unit concerning the 2020 property taxes on your property can be found online at:”

In which circle of hell is that how people talk, and what the what is dallascountytexastaxes.gov, a URL that redirects to a website with the heading Truth in Taxation? Will they be asking for my social security and bank numbers next?

Call the number on the card and find an answering system that puts callers on hold for awhile before hanging up or giving the option to leave a message into the void.

This is not some kind of scam attempt but an epically bad bit of communication from the State of Texas to you.

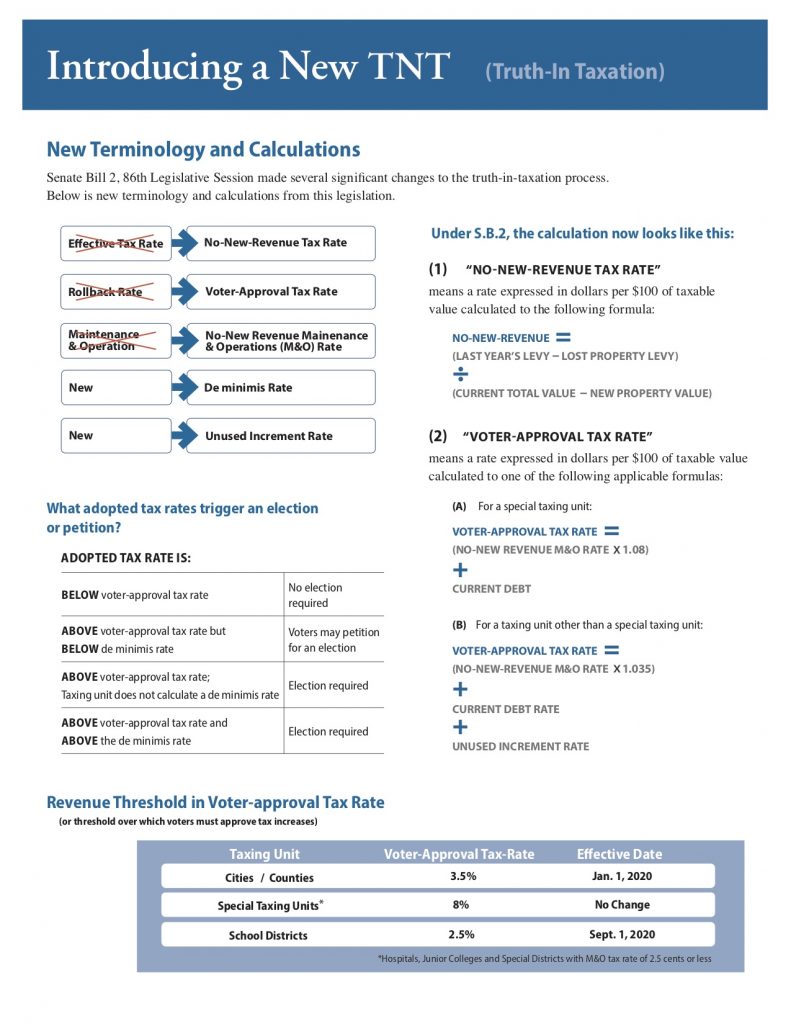

It’s part of a measure, signed into law by Gov. Greg Abbott in June 2019, meant to slow the growth of Texans’ property tax bills. Truth in Taxation is part of the law that is supposed to give taxpayers access to local tax-rate proposals.

Enter any address into the website today, and it will show the five local taxing entities and the property’s appraised value, but all the data is zeroed out, like this:

That’s because the Dallas Central Appraisal District was required by law to mail out notifications about Truth in Taxation on Aug. 1, before next year’s tax rates are proposed. Once they are, in about mid-August, anyone can see them on this website.

As the website states:

Truth-in-Taxation laws give taxpayers a voice in decisions that affect their property tax rates. Taxing units take the first step toward adopting a tax rate by calculating and publishing the no new revenue and voter approval tax rates. Below is a list of the proposed rates and the date and location of the public hearing to consider the tax rates.The hearings give taxpayers an opportunity to voice their opinions about the proposed tax increase.

Clear as mud, right?

What’s important to know about this postcard is that you still have to pay taxes. Those zeroes don’t mean anything. And taxes are still paid to the Dallas County Tax Assessor.

We don’t have an English translation of property-tax law for you (see below for the State of Texas’ attempt at it), but we can interpret the postcard:

Go to this website to keep up with next year’s proposed property-tax rates, when they are available maybe later this month, and see how they could affect what you are required to pay. There’s even a way to give feedback on the proposed rates and information about public hearings regarding the rates. And hey, if you don’t have the internet, you can request the same information to be mailed to you from the County Tax Assessor, John Ames. But either way, don’t try arguing with him because he doesn’t determine property valuations or tax rates, the Dallas Central Appraisal District does, and that is who sent you this postcard. Enjoy the new transparency.