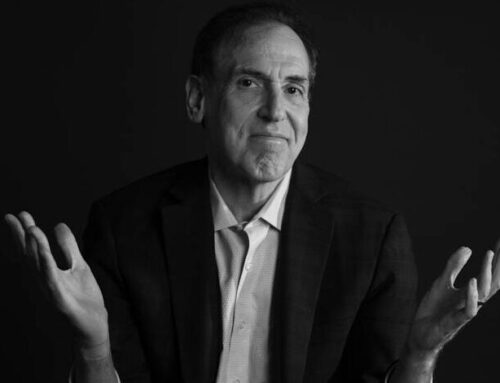

When Harold Abbey opened his monthly credit card statement, he was in for a surprise: an unauthorized charge to his account.

“Somebody went shopping online and charged $200.”

Abbey says his credit card was never lost or stolen, leaving him baffled as to how someone got his information.

“I am very careful with how I use my credit card. I never use my credit card to make online payments or to make phone payments.”

Abbey says he even plays it safe with his mailed statements.

“I shred every statement that I get so that nobody can intercept that information.”

His monthly credit card statements have also been delivered consistently so he doesn’t think anyone stole his mail to obtain the information.

After much pondering, Abbey says he has an idea of how somebody might have got his credit card number.

“I think someone got my card information at a restaurant or somewhere else where I made a purchase, and my credit card was out of my sight for a few minutes.”

Abbey says he suspects that once his credit card was taken out of his sight, someone could have jotted down his card information, or made a carbon copy of his credit card.

“You have no idea what someone will do with your credit card once it’s out of your sight. You trust that they are just going to run it and charge what they’re supposed to, but that might not always be the case.”

After he found the unauthorized charge, Abbey says he took all the steps he was supposed to. He called his credit card company to dispute the charge and he called the police to report it. His credit card company is not holding him accountable for payment, and the police have done all that they can because only the credit card company can decide to press charges, which thus far, it has elected not to do.

Abbey says he even tried to go directly to the vendor to find out information about who made the purchase with this card. Abbey says the vendor was unwilling to cooperate due to customer privacy policies.

He says trying to get information about the person who used his credit card has been a source of frustration.

“If they ordered something online, then it had delivered somewhere. I wish they could just give me the address this stuff was delivered to, and I’d go there myself, but they won’t tell me anything.”

To avoid this in the future, Abbey says he will be careful not to ever let his credit card out of his sight when he’s using it.

“I really thought I was doing everything I needed to, but I guess I need to do even more.”

Lt. Archie King of the Dallas Police Financial Crimes Unit says while most people do the obvious things to protect their credit card information, there are some security details they overlook.

“If you are waiting to pay with your card out, do not expose the numbers. Keep the card face down in your hand. Also, if there is a blank line on a receipt for tips or gratuity, and you are not using it, draw a line through it.”

King also says you should pay with cash when possible, carry few credit cards, sign your credit card, and always try and use your credit card in person – avoid making credit card payments via the internet, phone or mail.

Ultimately, King says protecting yourself comes down to common sense.

“Do not use credit cards in fly-by-night businesses or door-to-door sales. When paying by credit card at any business, the biggest factors in determining your exposure to a theft of your credit card number is the integrity of the establishment and the honesty of their staff,” he says. “Most of us can spot a reputable establishment, but scam artists are conniving and can be employed by businesses with the highest degree of integrity. The reputable establishment will likely assist you if an incident does occur.”